Planned Giving

1914 SOCIETY

What is Planned Giving?

Planned giving is a way to make a charitable gift to the Hingham Historical Society through thoughtful estate planning. A planned gift, as part of an overall estate plan, takes your needs as well as the needs of your loved ones into consideration while helping to support a cause or charity that is meaningful to you.

What a Planned Gift Can Do

- Allows the Hingham Historical Society to fulfill its mission to collect, preserve and promote Hingham history

- Ensures that the Hingham Historical Society continues to play a vital role in our community

- Provides much-needed support for educational and public programming

- Supports funding for preservation of our iconic buildings – the Hingham Heritage Museum at Old Derby, the Old Ordinary house museum, and the Benjamin Lincoln House.

Benefits of Membership in the 1914 Society

As a 1914 Society Member, you will enjoy the benefits that flow from sound estate and financial planning. Your generosity may result in an increased spendable income, immediate tax deduction, reduced real estate taxes and reduced capital gains taxes on appreciated assets.

Members of the 1914 Society receive invitations to an annual recognition event and other gatherings, acknowledgment in the Museum’s annual report and other donor listings, and communications about the latest happenings and endeavors at the Hingham Historical Society. Most importantly, 1914 Society members have the satisfaction of knowing that they are providing long-term support to allow the Hingham Historical Society to maintain financial stability and plan for the future.

Examples of Planned Gifts

There are a number of planned giving options that can help you realize your own philanthropic goals while ensuring the future financial stability of the Hingham Historical Society.

Gifts Now

Gift of Appreciated Stock

The gift of appreciated securities is most often in the form of common stock or mutual funds. Such a gift is a valuable way to benefit the Society and for you to receive tax benefits based on the fair market value of the securities.

Gift of Life Insurance

Make a gift or buy a policy making the Society the owner and beneficiary.

Gift of Real Estate

Real estate may be deeded outright to the Society or left by bequest. The irrevocable gift of property may provide an immediate tax deduction and avoid capital gains. Due to complexities, be prepared to work with the Society and qualified advisors to ensure that this is a suitable gift for both you and the Society.

Gifts that Pay Income

Charitable Gift Annuity

The gift annuity is an irrevocable gift of cash or securities where you receive a predictable fixed income for life. At termination, the Society receives the residual value of the annuity. There are also potential tax benefits depending upon your particular situation.

Charitable Remainder Trust

The remainder trust is an irrevocable gift of assets into a charitable trust that provides you a fixed (annuity trust) or variable (Unitrust) income for life or for a set term. At the trust’s termination, the trust assets become a generous gift to the Society. There are also tax benefits dependent upon your situation.

Charitable Lead Trust

The lead trust’s income payments are distributed to the Society for a set period of years, after which the assets are transferred back to the grantor or whomever the grantor has named the beneficiary. This provides generous annual support to the Society now, removed the asset from the estate and passes an asset to heirs with little or no tax. There is no immediate deduction for the lead trust.

Gifts Later

Bequests

A bequest is a gift made through a will or trust and is an easy, practical way to make a meaningful financial contribution to the Society without affecting your current finances. A bequest may be made for a specific dollar amount or piece of property, for a percentage of your estate, or for part or all of what remains of the estate after other bequests are carried out.

Retirement Plan Beneficiary Designation

In some cases, retirement assets can be the heaviest assets taxed in an estate. Naming the Society as beneficiary can avoid that taxation, enabling the asset to pass tax free to the Society. You may designate the Society a percentage beneficiary or a contingent beneficiary of a retirement plan.

Bank or Investment Account

Financial accounts can be a simple and inexpensive way to leave a legacy gift for the Society. Contact your financial advisor to see how easy the process is to make the Society beneficiary of a particular investment or bank account.

Making a Planned Gift to the Hingham Historical Society

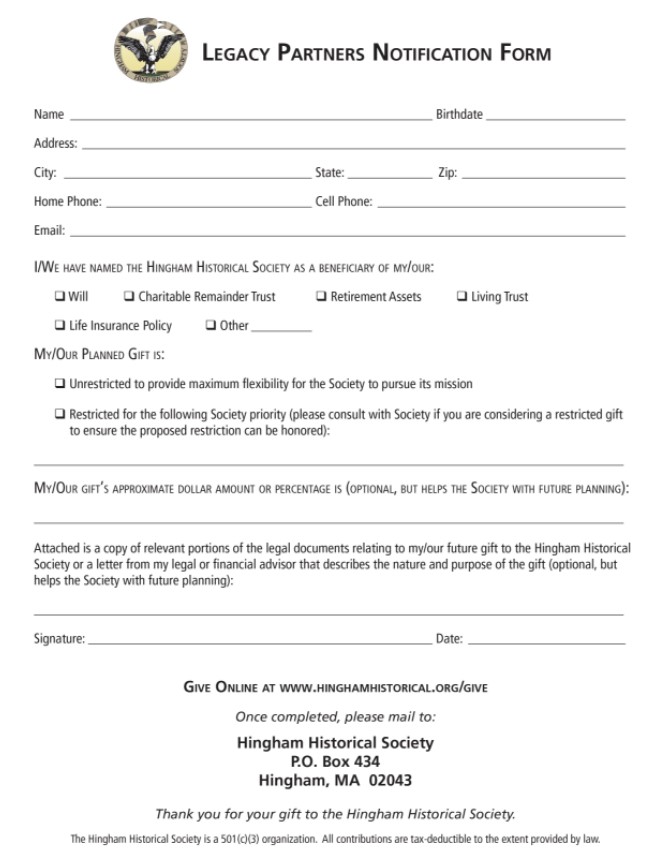

For more information on how to make a planned gift to the Hingham Historical Society and becoming a member of the 1914 Society, or to inform us of your existing plans that name the Society as a beneficiary, please download our notification form.

You may also contact the Development office at

tel: 781-749-7721 x7

email: development@hinghamhistorical.org

Please note that the information included here is not intended as legal advice, and you should consult with your attorney and financial planner when making a planned gift.

Do you have questions?

Please use the form below to contact us.

Planned Giving